How Vanguard Conquered the World

by James Corbett, The Corbett Report

September 25, 2023

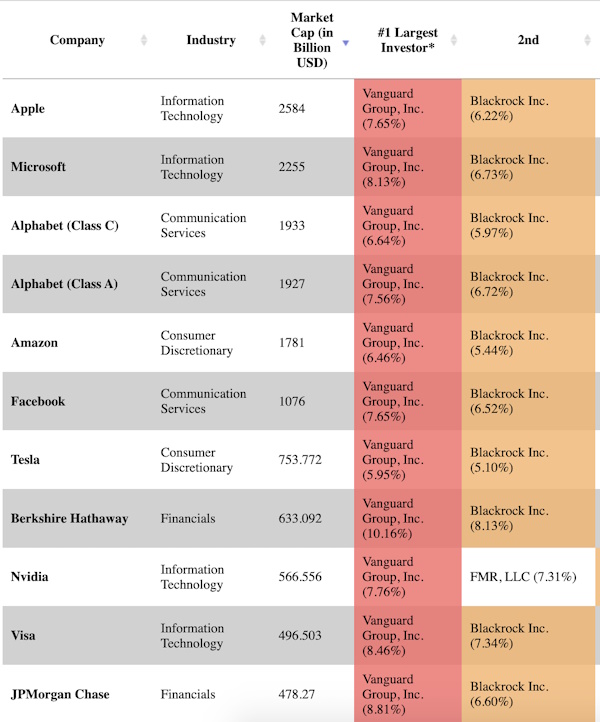

So, you’ve watched How BlackRock Conquered the World and you’re now aware of how this financial behemoth with trillions of dollars of assets under management has taken over vast swaths of the economy. You know how BlackRock is one of the top institutional investors in seemingly every major Fortune 500 company, and you understand how Fink and the gang are leveraging this incredible wealth to wield political and social power, directing industry and ultimately steering the course of civilization.

And since you did watch that podcastumentary to the very end, you’ll also remember how I pointed out that the top institutional investor in most of these companies is not BlackRock, but The Vanguard Group.

So what is The Vanguard Group? Where did it come from? What does it do? And how does this financial colossus fit into the overall BlackRock/ESG/Net Zero plan for the future of the (controlled) economy? Good questions! Let’s roll up our sleeves and get to work answering them.

The Rise of Vanguard

Just as the official history of BlackRock starts with the humbling of a rising star of the financial world—with BlackRock founder Larry Fink having supposedly learned a valuable lesson in risk management after he lost $100 million in a single quarter at First Boston investment bank—the Vanguard story, too, begins with the lemons-to-lemonade tale of a financial whiz kid.

In the Vanguard case, the story starts with John Clifton “Jack” Bogle, a titan of the financial industry whose conservative investment ethos was forged, we are told, in the crucible of The Great Depression. Born in New Jersey in May 1929—just months before the great stock market crash that wiped out his family’s fortune, drove his father to alcoholism and, ultimately, led to his parents divorce—Bogle was forced to buckle down and excel at his schoolwork even as he worked an assortment of jobs to help keep the family afloat.

Beating the odds, Bogle ended up getting a scholarship to study economics at Princeton. But, being an average student at a prestigious institution full of bright, ambitious young phenoms, Bogle knew he would have to produce a stellar senior thesis in order to stand out. Vowing to write about something that had never been covered before, he found his thesis topic in the pages of the December 1949 issue of Fortune magazine: the mutual fund industry.

Mutual funds, Investopedia informs us, are financial vehicles that “pool assets from shareholders to invest in securities like stocks, bonds, money market instruments, and other assets.” They had existed in the US in various forms since the late 19th century, but it was a series of acts passed by Congress in the wake of the 1929 stock market crash—including, most notably, the Investment Company Act of 1940—that paved the way for the explosive growth of the mutual fund industry in the mid-20th century. Bogle just happened to read the right article at the right time to catch the very first wave of what would eventually become a financial tsunami.

If Bogle had hoped to turn his flagging academic career around with his thesis, he succeeded. Not only did the thesis lead to a magna cum laude diploma from Princeton, it even caught the eye of Walter Morgan, founder of the prestigious Wellington Fund, the first balanced mutual fund in the United States. Morgan offered the young whiz kid a job at Wellington Management Company, the firm that managed the fund, and Bogle set out on what would become a storied career.

Becoming an assistant manager in 1955, Bogle oversaw a period of explosive growth for the firm and the mutual fund industry as a whole. He persuaded management to capitalize on the public’s growing interest in such investments by creating a new fund composed solely of equities, the Wellington Equities Fund. The new fund’s success and Bogle’s hard work cemented his position as Walter Morgan’s hand-picked successor. He would go on to become president of the company in 1967 and CEO in 1970.

It was a decision Bogle made at the height of the go-go ’60s bull market, however, that would prove to be what he later identified as his greatest mistake. In 1966, facing growing competition from a crop of newer, riskier mutual funds that were promising investors greater returns than the boring, conservative Wellington funds, Bogle forged a merger with with the investment counseling firm of Thorndike, Doran, Paine and Lewis, managers of the the up-and-coming Ivest Fund out of Boston.

But Bogle and his new partners quickly found they had different visions for the merged company. So, when the bull market ended in the 1970s and the stock market cratered, the partners banded together to have him fired as chief executive of Wellington Management Company.

Bogle would later identify the merger as the greatest mistake of his career and his subsequent firing as the lowest point of that career. But being let go would serve as the springboard for the creation of The Vanguard Group.

Bogle came up with a plan to turn the lemon of being fired into the lemonade of a new venture:

Jack’s response to his firing was to appeal to the boards of directors of the Wellington funds. These groups were separate from the board of the Wellington Management Company which had just fired Jack. While separate, the boards of the funds were essentially captives of the management company and the chairman of each fund’s board was traditionally the CEO of the management company. That was the way things were done in the mutual fund industry. Nevertheless, Jack suggested that each of the boards consider taking over the management company’s functions.

The boards of the various Wellington funds went along with this idea and they decided to keep Jack as their president. He then proposed that—in a radical break from industry norms—that the fund boards assume responsibility for their own administrative services, which had been hitherto provided by Wellington Management Company. Wellington Management would stay on as the funds’ investment advisor and principal underwriter, but the fee the funds paid to the management company would be reduced by $1 million to reflect this changeover in administrative services.

The okay from the board of the Wellington Group of Investment Companies enabled Bogle to form a new corporation to take over the administration of the eleven funds of the Wellington Group. He named it The Vanguard Group after the flagship of Lord Nelson’s fleet in the legendary Battle of the Nile.

“Together, the Wellington tie-in, the proud naval tradition embodied in HMS Vanguard, and the leading-edge implication of the name vanguard were more than I could resist,” he later explained.

In one stroke, Bogle had created an entirely new entity that ended up revolutionizing the industry: the “mutual” mutual fund, in which profits did not flow to the management company, but back to the funds themselves, meaning that, “as a practical matter, Vanguard attempted to operate at cost and pass the savings on to the shareholders.”

There was yet another hurdle Bogle had to surmount. The funds’ directors decided that Vanguard was to have the narrowest of mandates: it would only look after the funds’ administration, and would not be permitted to engage in advisory or investment management activities. Bogle overcame this restriction by proposing a completely passive fund, one that would not be actively managed but instead be tied to the performance of the S&P 500 index.

To say that the initial reaction of seasoned investors to this innovation was disparaging would be an understatement. Dubbed “Bogle’s Folly,” the idea of investing not in a single company but in an entire index was alternately derided as a “cop out,” as a “search for mediocrity,” and—given its eschewal of the traditional market ethos of picking winners and dropping losers—as “un-American.”

Unfortunately for Bogle, the criticism was not confined to mere name calling. The $150 million underwriting target for the very first mutual index fund, First Index Investment Fund, proved to be overly ambitious. Indeed, when initial underwriting was finished in August 1976, however, the fund had only collected $11 million. That wasn’t even enough to invest in all 500 of the S&P 500 stocks, as was the fund’s intention. So the fund managers settled for investing in the top 200 stocks, plus 80 others that had been selected as representative of the remaining 300 stocks. Nevertheless, they pressed ahead and by the end of the year the fund’s assets had grown by $3 million, to $14 million.

“Bogle’s Folly” paid off. Literally. The indexing model grew in popularity during the bull run in the early 1980s and Vanguard also launched new funds, including a bond index fund and a total market fund that captured the entire stock market minus the S&P 500.

Today, The Vanguard Group is the largest provider of mutual funds in the world and the second-largest provider of exchange-traded funds (ETFs) after BlackRock’s iShares. It boasts over $7 trillion of assets under management, and, as we have already seen, is the single largest institutional investor in just about every company of importance in the United States.

Who Owns the Shares?

OK, so, there you go. That’s the very condensed nutshell version of how Vanguard rose to prominence. And, as we know, Vanguard is now part of the shadowy financial cabal that owns everything.

. . . Or do we know that? This is where the fact checkers will come in to make their nasally point about how the conspiracy theorists are wrong. And, you know what? For once, they may not be entirely incorrect.

You see, the fact checkers at AAP and Reuters have tackled the question of Vanguard and BlackRock’s growing financial oligopoly in the way fact checkers do: by taking the most ridiculous framing of the argument they can possibly find and contrasting it with the opinions of their credentialed “experts.”

In AAP’s case, “Global corporate monopoly claim dances on edge of reality,” tackles the very serious issue of the Vanguard/BlackRock leviathan by refuting a Facebook video featuring someone discussing the problem while performing an interpretive dance.

After conceding that the companies are indeed the largest shareholders in a number of important companies, AAP then explains that this is for a good reason: they are “strategically investing their client’s [sic] money in order get a good return.”

Oh, OK, then.

More to the point, AAP then brings in Rob Nicholls—an associate professor of regulation and governance at the UNSW Business School—to lend gravitas to its main point: Vanguard and BlackRock don’t “own” Pepsi and Coke and Amazon and Apple and all the other companies cited by the conspiracy theorists. Instead, their holdings in these companies are largely passive investments—either ETFs, in which shares are purchased in proportion to market capitalizations, or index funds, in which shares are purchased in proportion to the index on which they are traded. Thus the purchase and selling of shares in these companies is largely automatic: when a company’s market cap falls or when its stock gains in relation to the overall index, the associated ETF or index fund would be obligated to offload or purchase shares in order to maintain the fund’s mandate.

Thus, to the extent that Vanguard and BlackRock holdings represent passive investment, these holdings do not have any sway over the companies or their actions. The argument here is that Vanguard can’t threaten to sell Apple shares if Apple doesn’t conform to the woke agenda because Vanguard can’t really sell those shares on a whim. Instead, Vanguard is obligated to hold Apple shares in proportion to Apple’s position in the S&P 500 index (at least when it comes to their S&P 500 index fund). And, where there is no credible carrot to reward “good behaviour” (buying shares when Apple does what Vanguard wants) or stick to reward “bad behaviour” (selling shares when Apple doesn’t do what Vanguard wants), then there is no way for Vanguard to directly influence Apple’s behaviour.

Besides, as Lorenzo Casavecchia, a “senior lecturer at UTS Business School,” told AAP FactCheck, “an investor can only control a company if they have more than half of the votes cast at a general meeting.” But even when you combine the shares of the so-called Big Three investors (BlackRock, Vanguard and State Street), their holdings in these major companies do not even approach a majority. Often, they each hold a single-digit percentage point of overall shares.

What’s more, as Reuters point out in their fact check on the topic (citing a BlackRock spokesperson, of course): “BlackRock itself is not a shareholder” in these companies. Instead, “the owners of these securities are our clients, through their investments made on their behalf via the funds managed by Blackrock.”

The same goes for Vanguard, which likes to brag in its corporate PR that Vanguard “is owned by its funds, which in turn are owned by their shareholders—including you, if you’re a Vanguard investor.” So, the way Vanguard frames it, when you inevitably end up at the question of “who owns Vanguard?” (or “who owns BlackRock?” for that matter), the answer will be: “The investors do!”

So, you see? Vanguard and BlackRock (and let’s not forget State Street) don’t “own” the major corporations. They don’t manage those companies or have any influence over them. And, besides, their shares are held on behalf of their investors, so it’s the investors who are really the biggest holders of Apple and Exxon and Walmart and all the rest.

Well, I guess that sums it up, folks. Nothing more to see here, right?

Vanguard, BlackRock and the Shadows of Power

Oh, wait. Of course there is more to this story.

True, Vanguard and BlackRock and State Street don’t “own” these companies in the straightforward sense, but to say that the trillions of dollars of assets under their management doesn’t bring with it the clout needed to sway the direction of corporate America as a whole or even of select companies individually is beyond naive.

Indeed, as many serious, credentialed researchers—as opposed to the interpretive dancing TikTokers “refuted” by the fact checkers—have pointed out, there are ways that these investment companies can flex the muscles that come with trillions of dollars in investable capital.

As even AAP concedes in its fact check (citing Adam Triggs, research director at ANU’s Asian Bureau of Economic Research), there is evidence that common ownership of competing firms (like Coke and Pepsi) reduces competition, helping to cement the corporatocracy into place.

This common sensical and obvious point is backed up by researchers like John Coates at Harvard Law School, whose paper, “The Future of Corporate Governance Part I: The Problem of Twelve,” outlines how “in the near future roughly twelve individuals will have practical power over the majority of U.S. public companies.”

It shouldn’t take an economist or a university professor to imagine how such intense concentration of ownership could lead to a raft of problems, from higher prices on consumer products to reduced wages and employment. But while you hold your breath and wait for the fact checkers to tell you why this is a totally wonderful turn of events that won’t have any bad consequences whatsoever, you should take the time to digest Coates’ own summarization of the inherent threat that such an intense concentration of ownership poses for the market and even for the rule of law itself:

Indexation, private equity, and globalization threaten to permanently entangle business with the state and create organizations—advisors to index funds and private equity funds—controlled by a small number of individuals with unsurpassed power. That concentration of control underscores the gap between ordinary citizens’ experience of disengagement and distance from their government made visible in 2016, and the increasing wealth gap between the ultra-rich and the bulk of the population. Politics is shaped by perceptions. Law—itself a function (in part) of politics—will almost certainly change in response to these trends. The only question is how.

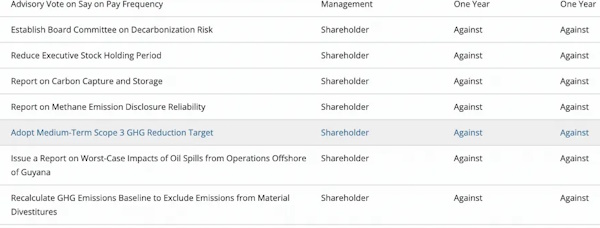

Then there’s the question of votes. Of course, shareholders get to vote in corporate elections, including electing directors and voting on shareholder resolutions. So who gets to vote when the shares are actually held by an asset manager on behalf of its clients? Traditionally, it’s Vanguard and BlackRock who actually do the voting. Vanguard calls it “stewardship” and likes to brag on its website how its managers “vote in accordance with the funds’ proxy voting policies.”

The funds, of course, tell the finger-pointers to just relax. After all, they don’t coordinate their votes as a bloc, so their small percentage of votes won’t be a decisively sway anything, anyway. But research published in 2017 found that the Big Three do in fact “utilize coordinated voting strategies and hence follow a centralized corporate governance strategy.” Heck, even Bloomberg can see through the propaganda suggesting that their voting power is small and insignificant:

And yet voting power is voting power. The fund companies’ combined votes and back-channel jawboning, in which they make their views known to directors and chief executive officers, could swing the outcome of important matters such as mergers, major investment decisions, CEO succession, and director elections—even if no fund house has the ability to decide the outcome of such matters alone. They’re potentially the most powerful force over a huge swath of America Inc. Alarm bells have begun to go off with some regulators, as well as with an ideologically diverse array of academics and activists.

To find out how these votes actually work, you can search Vanguard’s public record of proxy votes. For what it’s worth, a random search of the most recent Vanguard proxy votes for Exxon shows that Vanguard voted against every single resolution, including the ones pushing the woke green technocratic agenda.

But the issue remains: if the managers get to vote (even if its “on behalf of” their investor-owned funds) in accordance with ill-defined and ever-changing “principles,” who really gets to wield the power of the shares?

This is not a trivial issue. BlackRock, at least, recognizing that its claim to be simply a neutral asset manager rather than a civilization-shaping force is undermined by its ability to wield shareholder votes, has made a big PR campaign about introducing and then expanding a scheme to allow investors to opt for voting their own shares.

But when considering the <sarc>incredibly difficult</sarc> question of whether the people running the firms that collectively manage tens of trillions of dollars of assets have any sway whatsoever over the firms they are investing in, there is a simple answer: yes. Yes, they do.

As I explained in How BlackRock Conquered the World, even the boffins and eggheads at the prestigious universities have been forced to concede (after years of careful study, no doubt) that Larry Fink doesn’t pen his annual “Letter to CEOs” just for the fun of it. The word of Fink does carry weight in corporate boardrooms.

Sometimes referred to as a “call to action” to corporate leaders, these letters from the man stewarding over a significant chunk of the world’s investable assets actually do change corporate behaviour. That this is so should be self-evident to anyone with two brain cells to rub together, which is precisely why it took a team of researchers months of painstaking study to publish a peer-reviewed paper concluding this blindingly obvious fact: “portfolio firms are responsive to BlackRock’s public engagement efforts.”

So here’s the $20 trillion question: how much power does a Larry Fink or a Jack Bogle really wield over the world through their companies?

Well, on the most basic level, the latter question is easy to answer. Jack Bogle was forced out of the CEO position at Vanguard in 1996, retired as chairman in 2000, and died in 2019, so he isn’t wielding much influence these days.

But here’s the more serious point: Larry Fink at BlackRock and Mortimer “Tim” Buckley (the current chairman of The Vanguard Group) do exert power over the economy and, ultimately, over society. As long as their company’s remain the top institutional investors in the majority of the stock market, the only question is: how much havoc they will wreak by imposing their will on the world?

You have already seen Larry Fink and his woke ESG agenda-pushing. So, how about Buckley? Well, to his credit, Buckley did pull The Vanguard Group out of the Net Zero Asset Managers initiative, claiming that Vanguard is “not in the game of politics” and that “our research indicates that ESG investing does not have any advantage over broad-based investing.” And while Vanguard does offer so-called “sustainable” funds and ESG index funds, they amount to a miniscule percentage of the group’s offerings, with Buckley saying he wants to “allow investors to express their values and preferences” but the decision whether or not to pursue ESG investment “has to be an individual investor’s choice.”

Regardless of how much of this is just corporate blather designed to protect Vanguard from the growing ESG backlash (and subsequent withdrawal of investment funds) that has afflicted BlackRock in recent years, the underlying problem persists. Even if Buckley were an angel descended from heaven to protect us from the green woke mobs, who is to say his successor would be an angel, too? The very fact that people like Fink and Buckley are in a position to sway corporate decisions is itself the problem—not the particular ways they wield (or refrain from wielding) that power.

Ironically, this point was not lost on Jack Bogle. You’ll note that Bogle is not a name synonymous with nefarious corporate scheming in the same way that Fink currently is. In fact, in recent decades the now-deceased Bogle has become something of a saint in the investment world.

His idea of “mutualizing” the mutual funds by cutting out the management company middlemen and thus greatly reducing fees has put upwards of a trillion dollars back in the pockets of ordinary investors (and thereby kept it out of the pockets of Wall Street managers). And his common sense, down-to-earth investment strategies that eschewed get-rich-quick schemes and fancy quant-driven investment trends gave rise to an entire movement of investors who call themselves “Bogleheads” (yes, really), and continue to organize conferences in his name.

So what was Bogle’s take on the astonishing growth of Vanguard and BlackRock in the years before his death?

Most observers expect that the share of corporate ownership by index funds will continue to grow over the next decade. It seems only a matter of time until index mutual funds cross the 50% mark. If that were to happen, the “Big Three” might own 30% or more of the U.S. stock market—effective control. I do not believe that such concentration would serve the national interest.

He’s not wrong there, at least.

As always, I will note that the incredible power that the Finks and the Buckleys of the world wield is in fact our power, derived from our money through our investments of our time, our energy, our labour and our productive power in the service of their corporate agenda. Thus, the fundamental solution to the problem of Vanguard and BlackRock will not come from some outside force. It will come when we withdraw our wealth from their system.

For those who are interested in the solution to the Vanguards and the BlackRocks of the world, they are directed to my recent #SolutionsWatch episode on the subject.

Connect with The Corbett Report

Cover image credit: geralt

Truth Comes to Light highlights writers and video creators who ask the difficult questions while sharing their unique insights and visions.

Everything posted on this site is done in the spirit of conversation. Please do your own research and trust yourself when reading and giving consideration to anything that appears here or anywhere else.